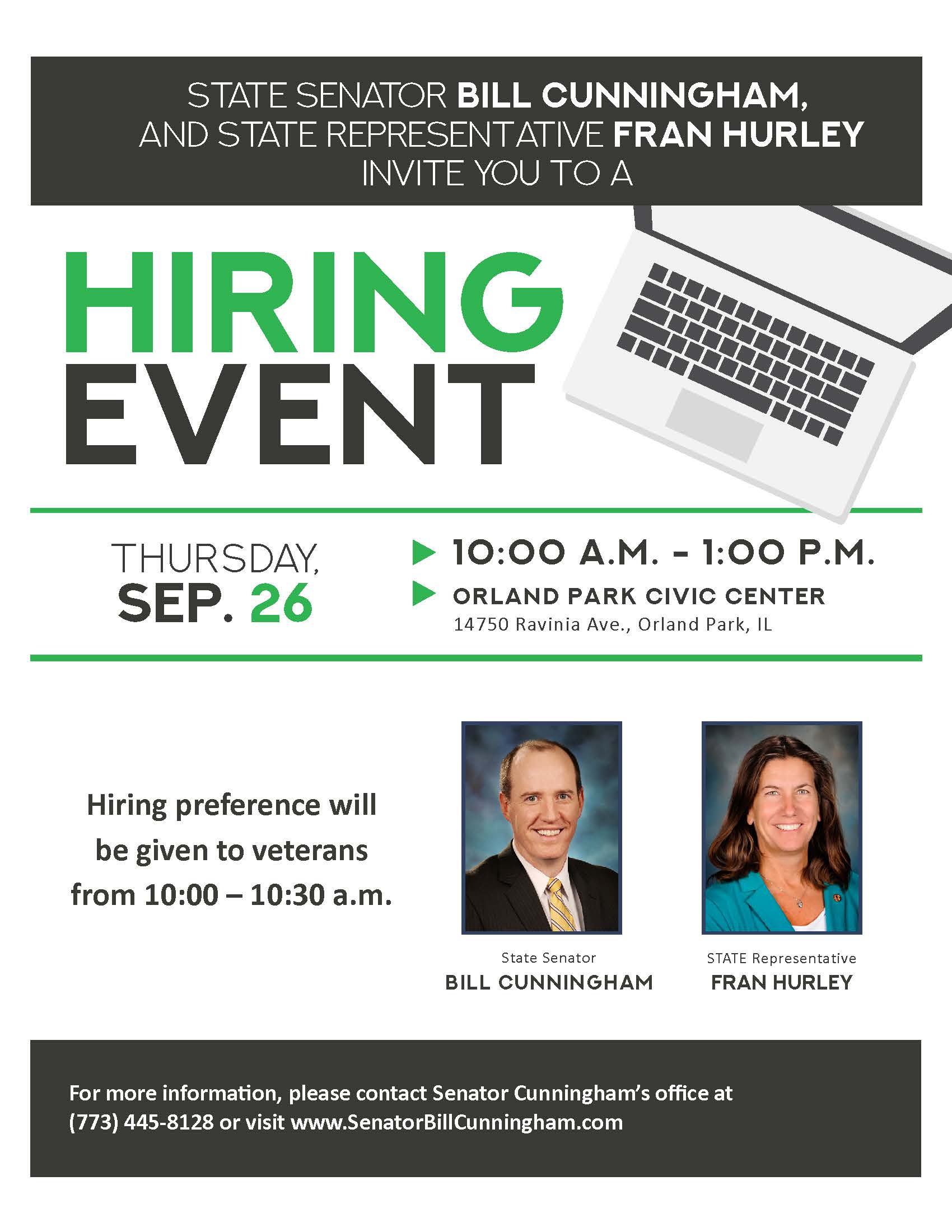

Cunningham invites area employers to attend September 26 job fair

- Details

- Category: Press Releases

ORLAND PARK – Area employers and staffing agencies will have the opportunity to connect with jobseekers during an Orland Park hiring event Thursday, September 26.

ORLAND PARK – Area employers and staffing agencies will have the opportunity to connect with jobseekers during an Orland Park hiring event Thursday, September 26.

State Sen. Bill Cunningham and State Rep. Fran Hurley co-present the hiring fair, which will take place from 10 a.m. to 1 p.m. at the Orland Park Civic Center, 14750 S. Ravinia Ave.

“There’s a lot of economic opportunity in the southwest suburbs and plenty of qualified individuals ready to take advantage of it,” said Cunningham, a Democrat who represents portions of Chicago and the southwest suburbs.

Hiring preference will be given to veterans for the first half hour of the event.

In previous years, jobseekers had the chance to explore careers with companies in various sectors, including construction, hospitality, sales, retail, health care, state government, trucking and transportation, manufacturing, clerical, industrial and more.

“Our goal is link as many employers as possible with qualified candidates regardless of what sector they’re in,” Cunningham said. “This hiring event provides employers with a chance to interact with these individuals and make needed additions to their staffs.”

Jobseekers and employers are asked to register in advance at www.senatorbillcunningham.com. For more information, contact Cunningham’s district office at 773-445-8128.

Governor signs Cunningham’s legislation to deter misconduct in jails

- Details

- Category: Press Releases

SPRINGFIELD – New legislation sponsored by State Senator Bill Cunningham and signed into law by Gov. JB Pritzker would crack down on public indecency and sexual misconduct in jails.

SPRINGFIELD – New legislation sponsored by State Senator Bill Cunningham and signed into law by Gov. JB Pritzker would crack down on public indecency and sexual misconduct in jails.

Under Senate Bill 416, if a defendant is found guilty of an administrative infraction related to public indecency or sexual misconduct while in jail it will be an aggravating factor in the defendant’s sentencing.

“There’s no excuse for this sort of behavior in jails and we need to start taking these offenses seriously and impose real consequences for them,” said Cunningham, a Democrat who represents portions of Chicago and the southwest suburbs. “This measure will provide a serious deterrent to prevent these infractions and make our jails safer both for inmates and jail personnel.”

The measure will go into effect January 1, 2020.

Cunningham’s measure to combat overdoses signed into law

- Details

- Category: Press Releases

Senate Bill 1258 allows require emergency medical technicians in Chicago to report treatment of an individual experiencing a suspected or actual opioid overdose to the city for use in the Overdose Detection Mapping Application (ODMAP), developed by the Washington/Baltimore High Intensity Drug Trafficking Area (HIDTA).

“People are dying every day from overdoses and we need new tools to help combat this crisis,” said Cunningham, a Democrat who represents portions of Chicago and the southwest suburbs.

The ODMAP provides real-time overdose data throughout an area to mobilize an immediate response to an overdose spike. Each suspected overdose is plotted to a map that allows local officials to identify trends and develop strategies to more effectively respond to overdoses.

“This technology will be incredibly effective in improving overdose response time and fostering the development of new approaches that authorities use to fight the opioid crisis,” Cunningham said. “I feel confident that after we implement this program, we’ll see a lot more lives saved and a lot more people seeking help for their addiction.”

Senate Bill 1258 will take effect immediately.

Governor signs Cunningham’s measure to deter school threats

- Details

- Category: Press Releases

“False threats are not only terrifying for students, parents and faculty, they also divert emergency response resources away from places where they’re really needed,” said Cunningham, a Democrat who represents portions of Chicago and the southwest suburbs. “This legislation will provide us with a mechanism to impose consequences that will deter these threats from being made.”

Under Illinois law, a person commits the offense of disorderly conduct when he or she calls 911 for the purpose of making a false complaint or providing false information, including a threat against a school.

House Bill 1579 expands the offense to include threats made on any platform, including social media. Current law only covers threats made by telephone or threats that specifically mention the use a bomb.

If an individual is convicted of transmitting a false threat, he or she must also pay for the costs of the emergency response the threat triggered.

In drafting the legislation, Cunningham worked closely with State Rep. Kelly Burke (D-Evergreen Park) and Palos Hills Police Chief Paul Madigan, whose department heightened security measures at local schools several times last year due to threats on social media.

“According to law enforcement in my district, threats of violence against schools are increasingly coming through social media rather than the phone and make no mention of a bomb,” Cunningham said. “This trend is only going to continue and we need to make sure we update our statute to keep it aligned with modern concerns.”

The measure further allows the court to order a mental health evaluation for a minor charged with disorderly conduct for transmitting a threat to a school.

“Threats to schools are usually linked with mental health issues that need to be addressed for the benefit of both the individual who made the threat and those around them,” Cunningham said. “Allowing for mental health evaluations in these circumstances will allow law enforcement and medical professionals to work together to best resolve these cases.”

The measure will go into effect January 1, 2020.

More Articles …

Page 57 of 110